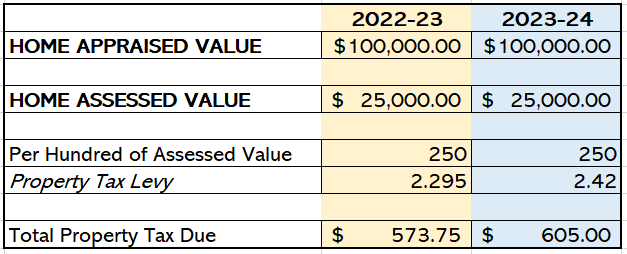

LYNCHBURG, Tenn. — The Metro Council took the first step toward the new fiscal year, which begins on July 1, by approving the first reading of the 2023-24 Metro Budget on Monday. That budget is based on a $2.42 property tax levy – up from $2.295 last year. That 13 plus cent increase would represent an annual increase of approximately $31.25 for a home with an appraised value of $100,000. That’s around $2.60 per month. Those living in the Urban Services District (the former Lynchburg city limits) will pay one cent more.

The first reading passed by a 12-2 margin with Shane Taylor, Douglas Carson, Arvis Bobo, Gerald Burnett, Amy Cashion, Jimmy Hammond, Bradley Dye, Greg Guinn, John Taylor, Dexter Golden, Houston Lindsey, and Sunny Rae Moorehead voting in favor and Robert Bracewell and Peggy Sue Blackburn voting against. Budget Committee member Marty Cashion was absent from the meeting.

The 2022-23 Metro Budget discussions got a little heated last year with one side wanting to freeze the tax rate and the other lobbying for public safety pay increases to aid with employee retention. (To read our full coverage of that 2023 meeting, click here.) In 2022, the Council finally passed the budget two days before the state deadline in a special session. (To see the voting of that final reading, click here.)

No new innovation, no expansion of services

Things ran a bit more smoothly this year.

Prior to Monday night’s first reading, members of the Metro Budget Committee, Mayor Sloan Stewart, and multiple department heads met to go over department budgets line-by-line. This year’s committee included Chair Gerald Burnett, Amy Cashion, John Taylor, Marty Cashion, and Bradley Dye. Those meetings were open to all other Metro Council members as well as the general public.

Before Monday night’s vote, Chair Burnett addressed the Council to explain the process. He stated that he originally requested a 15 percent expenditure reduction from all department heads.

“What we discovered is that they don’t have any unnecessary spending,” Burnett told his fellow council members. “There’s nothing new in here. No new innovation, no expansion of services. We’re just maintaining the current level of service.”

Burnett went only to explain that many of the increases on the expenditure side were state-mandated. All Moore County elected official’s salaries will go up by a 5.6 percent increase, as set by the state. The state also now requires all local governments to maintain a 15 percent general fund balance – up from five percent the previous year.

“This is one of the reasons we are recommending that we move $400,000 in American Rescue Plan Act (ARPA) funds into the General Fund,” Burnett explained.

Two council members, Peggy Sue Blackburn and Robert Bracewell, bristled at the increase. Blackburn suggested that Metro cap local government employees health insurance benefits to a 80/20 match for the employee only. Metro currently pays a 80/20 match for both the employee and any covered family members.

“We looked into that,” Chair Burnett told Blackburn. “But we decided that it’s the one benefit that actually helps with employee retention. It’s a good benefit and it keeps our employees here. We need to keep our workforce if we can.”

“That’s an estimated saving of around $130,000 dollars,” Bracewell responded.

“I’m not sure about that number,” Chair Burnett answered.

“You also have to look at the money it costs to train new employees when you lose one to a surrounding county,” Shane Taylor responded – inferring that the savings would be a wash.

Moore County Tax Relief Program

On Monday, Chair Burnett recommended that Metro Moore County adopt a program similar to the State of Tennessee’s Property Tax Relief Program. The program exists for elderly and disabled homeowners as well as disabled veteran homeowners or their surviving spouses. To learn more about the state program, click here.

Moore County’s plan would cap property taxes of qualified individuals. Again, Bracewell bristled.

“I promise I’m not just trying to be contrary. I understand it’s going to low income or elderly but we’re taking from the haves and giving it to the have nots and that’s not justice,” Bracewell stated.

According to the Budget Committee the estimated number of households in Moore County who would qualify for the program is less than 100.

Peggy Sue Blackburn made the motion to adopt the program and Shane Taylor seconded. At the roll call vote, all members of the Council present voted in favor of adopting the Moore County Property Tax Relief Program except Bracewell.

The Tennessee Comptroller’s office encourages all counties and metros to submit an approved budget by no later than the end of the fiscal year, which takes place on June 30. Metro’s Charter requires that all resolutions and budgets that involve public monies pass three separate readings. The Council will meet again on Monday, June 19 at the former American Legion Building at 6:30 p.m. There will be a public meeting prior to the regular meeting in which members of the public can address the Council with any concerns. •

{The Lynchburg Times is an independently-owned, community newspaper located in Lynchburg, Tennessee the home of The Jack Daniel Distillery. We focus on public service, non-partisan, rural journalism. We cover the Metro Moore County government, local tourism, Moore County schools, high school sports, Motlow State Community College, as well as whiskey industry news and regional and state stories that affect our readers.}