LYNCHBURG, Tenn. — With our gorgeous rolling hills, proximity to Tims Ford Lake, and charming small town feel, is it any wonder that retirees are flocking to picturesque Lynchburg?

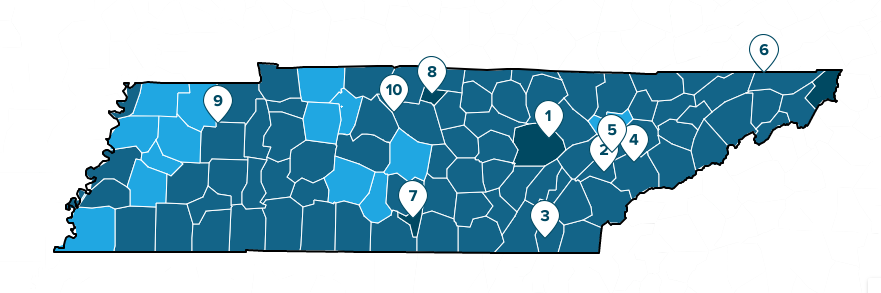

According to a recent SmartAsset study, Lynchburg ranks as the seventh most tax-friendly place in the state of Tennessee. Fairfield Glade ranked number one followed by 2) Tellico Village, 3) South Cleveland, 4) Eagleton Village, 5) Farragut, 6) Bloomingdale, 7) Lynchburg, 8) Hartsville/Trousdale County, 9) McZenzie, and 10) Green Hill.

According to SmartAsset, to find the most tax friendly places for retirees, their study analyzed how the tax policies of each city would impact a theoretical retiree with an annual income of $50,000. Their analysis assumed a retiree receiving $15,000 from Social Security benefits, $10,000 from a private pension, $10,000 in wages and $15,000 from a retirement savings account like a 401(k) or IRA.

To read the complete study, follow this link.

In Tennessee, there is no state income tax and social security income is not taxed at either the state or federal level. Withdrawals from retirement accounts are also no taxed and public and private pensions are also not taxed.

Last month, the Metro Council passed the 2022-23 Metro Moore County General Budget with a new tax rate of $2.295 – a four cent increase over the previous year. At the new $2.335 tax rate, a person with a $100,000 home would pay an estimated $10 extra dollars in property tax per year. •

{The Lynchburg Times is the only locally-owned newspaper in Lynchburg and also the only woman-owned newspaper in Tennessee. We cover Metro Moore County government, Jack Daniel’s Distillery, Nearest Green Distillery, Tims Ford State Park, Motlow State Community College, Moore County High School, Moore County Middle School, Lynchburg Elementary, Raider Sports, plus regional and state news.}